We posted a new version of Subsidy Tracker , Good Jobs First’s database of company-specific subsidy awards from state and local governments across the country as well as federal agencies. During this round of updates, we added over 17,000 entries from 112 state and local programs from 28 states. We also updated the federal programs. We also added nine megadeals, which we define as state and local subsidy packages over $50 million for a single project.

We collected 2020 (calendar and fiscal years) data from 19 programs and 2021 data from four programs. This data covers the COVID pandemic. One of the largest awards during the pandemic came from New York state film subsidy program — $22.7 million went to a production company working with Sony and $21.8 million to another working with Amazon in 2020, for example – and from Allen County, Indiana where General Motors has been benefiting from hundreds of millions of dollars in property tax abatements. Some programs we updated are quite expensive. For example, New York paid out over $473 million in film subsidies to 93 companies; Utah approved over $110 million to 18 companies (the money will be paid out over multiple years); property tax abatements in DC cost almost $30 million.

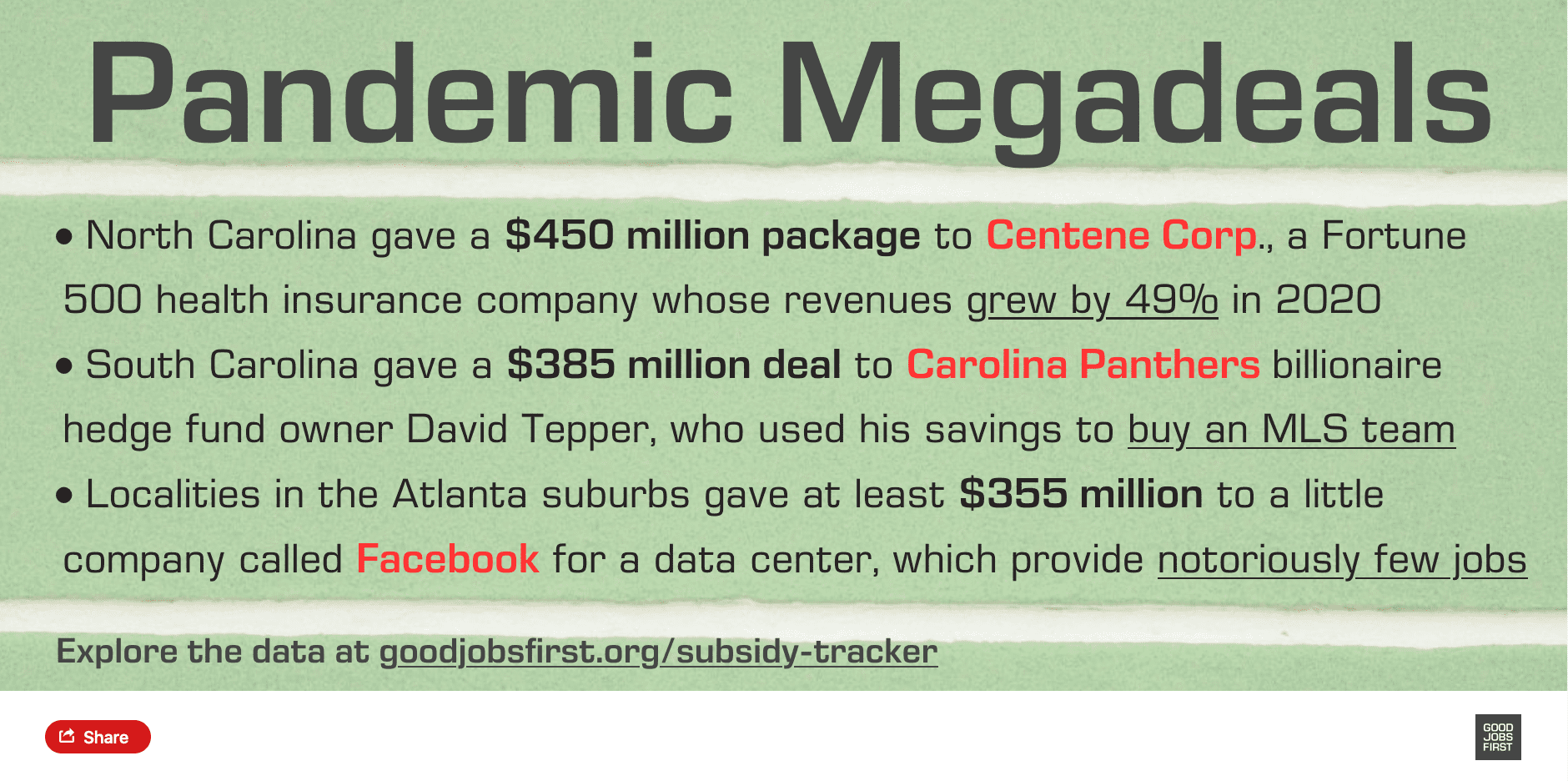

Six megadeals were awarded to corporations during the pandemic as well. The costliest were North Carolina’s $450 million package to Centene Corporation in Charlotte; South Carolina’s $385 million deal for the Carolina Panthers for relocation of the team’s training facilities; and minimum of $355 million from localities in the Atlanta suburbs for a Facebook data center complex (the amount most likely will grow with Facebook’s planned expansions).

We need to wait a little longer for more comprehensive data to understand state and local subsidy behavior during the pandemic. Nevertheless, those megadeals are a worrisome sign that state and local governments have been providing individual large awards to profitable and wealthy companies rather than to better approaches such as giving more aid to small businesses.

Some data we updated is not fully transparent. The Arizona Department of Revenue provides links to local Government Property Lease Excise Tax agreements (a property tax reduction program) in a handy online database . We can see who gets the subsidies but not how much. Among recipients are Tesla, Boeing, and Verizon Wireless. Similar partial lack of disclosure can be seen in the Promoting Employment Across Kansas ( PEAK ) program, in which Amazon, Cargill and Spirit AeroSystems, Inc. are among the recipients.

Some program data reinforces questions about the necessity of those subsidy awards for programs such as Maine’s Business Equipment Tax Reimbursement (BETR). This controversial property tax abatement program gives out a lot of small tax abatements to companies. One can question whether those abatements do really encourage companies to grow in the state. For example, does $82,000 tax abatement for a CVS story really cause the corporation to stay or expand in Maine? Some of the awards are very small, even in hundreds of dollars but when summed-up, they account for over $23 million of lost revenue. The program is phasing out. Its successor, Business Equipment Tax Exemption (BETE), unfortunately, has zero transparency.

There is more in Subsidy Tracker . We encourage users to explore the data, learn about economic development subsidies, raise questions about the legitimacy and effectiveness of those programs, and work with us and our partners to reform those programs.

PS. I would like to acknowledge our intern Katie Hawkinson for her contribution to collecting the data.

View this graphic online.