Philly schools lose more money to tax breaks than any district in the country, a new report says

The Philadelphia Inquirer wrote about a new Good Jobs First report that found no school district in the country lost more revenue to corporate tax abatements than Philadelphia schools.

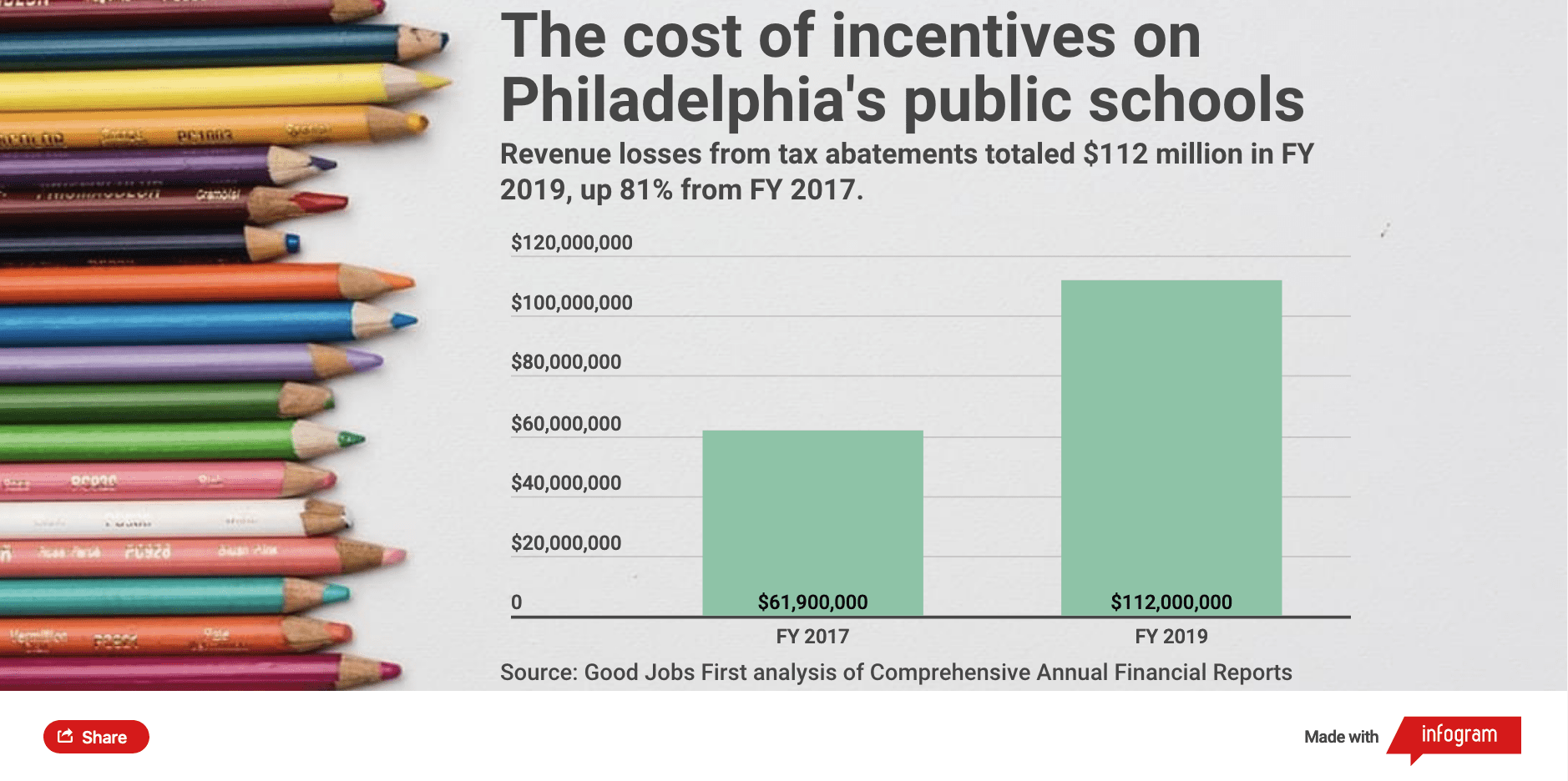

It lost $112 million in fiscal year 2019, the data revealed.

Philadelphia City Councilmember Helen Gym, during an event hosted by the nonprofit, said the idea of corporate subsidies being the way to attract businesses is “mythology.”

“If you care about Black Lives Matter, if you care about race, if you care about racial justice, you’ve got to care about the impact of corporate tax subsidies on public school systems,” she said.

Read the full story in the Inquirer.

Chalkbeat also wrote about our findings and event.

“Kansas City, a district with about 14,000 students compared to Philadelphia’s more than 120,000, loses $38 million a year to tax abatements, or 24% of the local tax revenues it collects, said Superintendent Mark Bedell. And the amount has increased by 40% since 2017, he said.

This is nothing short of structural racism, ‘the perpetuation of racially discriminatory practices’ such as redlining, Bedell said. At the same time, the abatements don’t seem to be having the desired effect.

‘I told the mayor, if this tool were used correctly, we should be seeing reinvestment in those communities,’ Bedell said. ‘But I’m not seeing a lot of economic development.’ ”

Read the full story in Chalkbeat.

It’s worth noting the “independent” study cited by city officials in defending its corporate subsidy program was produced by site consultants, part of an industry that helps businesses track down corporate subsidies. As Good Jobs First’s Greg LeRoy has written, some site consultants work on commission, keeping up to 30% of the discretionary incentives they win for clients, “so they have every self-interest in upping the ante/keeping public officials in the prisoners’ dilemma.”

The report, “Abating Our Future: How Students Pay for Corporate Tax Breaks,” found public schools lost $2.37 billion to corporate tax breaks.

Watch the full conversation, which featured Gym, Bedell, College of Charleston Professor Kendall Deas and the report’s author Christine Wen, on Facebook or YouTube.

See also: Corporate Tax Breaks Siphon Critical Funding from Philadelphia’s Public Schools.