Entire books and reports have been written about the ways companies scour the globe for economic development subsidies. But the lack of universal reporting standards, language barriers, and complicated governmental and tax structures make it difficult to examine just how much individual corporations benefit from government assistance across the world. A new Financial Accounting Standards Board (FASB) rule, Topic 832, offers a tiny window to this global practice.

FASB is an independent, private organization that creates rules on how companies should account for and report their finances (it’s the public sector equivalent to the Governmental Standards Accounting Board, or GASB). As we discussed in previous blogs, the new FASB standard requires publicly traded companies to disclose in their financial statements information about some subsidies, such as grants, granted by governments, including foreign ones (though some of the biggest taxpayer benefits companies receive, like property tax breaks, were omitted from the rule).

I looked at the new reporting by several global companies and here is what I have learned about corporate use of subsidies internationally.

Because the rule has limited reporting requirements, company subsidy disclosure can be incomplete, inconsistent, and is often missing. For example, we know Amazon has received subsidies globally, including for its second headquarters in Virginia. Yet, its financial statement is missing the reporting (the company reports, under a separate note on income tax, how much tax credits reduced its income tax liability, but that does not reflect public support through grants or rebates for example).

Some companies that report international subsidies omit the actual amounts or obscure the data by lumping all subsidies from multiple countries into a single paragraph with no breakdown by country. Take Micron Technology, which in its most recent 10-K reported this: “We receive incentives from governmental entities primarily in India, Japan, Singapore, Taiwan, and the United States principally in the form of cash grants and tax credits.”

But, in some cases, we can see some specifics.

As in the U.S., companies benefit from various subsidies offered by national and local governments. Companies get tax credits and refunds, cash grants, free or discounted land, facility build-outs and improvements. Some subsidies come with investment and job creation requirements and clawback provisions.

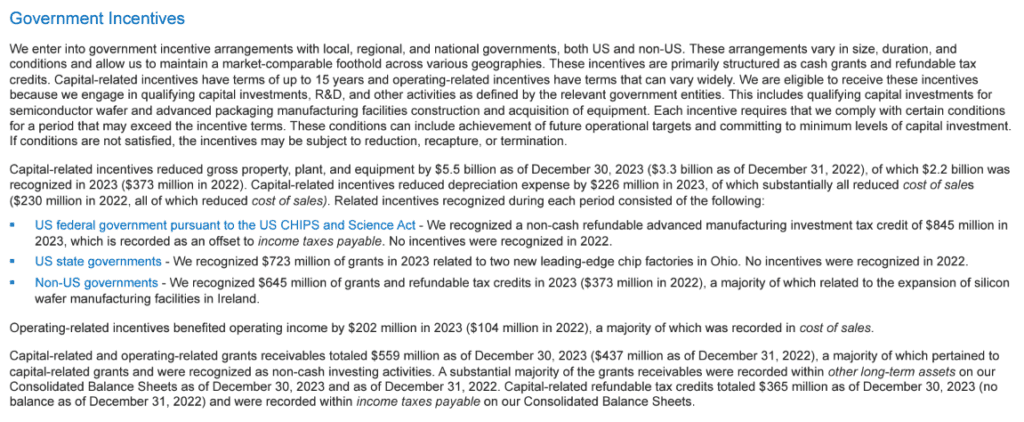

Global companies have received massive public support from developed countries. For example, in 2022 and 2023, Ireland, a historical tax haven, provided Intel with $1 billion in grants and refundable tax credits for a manufacturing facility. And Ford is set to get $434 million* (C$590 million) by 2033 for its EV manufacturing facility in Ontario, Canada.

Companies also get subsidies from developing countries, promising leaders of the world’s poorer economics development and a bigger tax base — only a full accounting of that assistance can let residents know if their promises materialize. Tesla received $76 million in grants for its Gigafactory in Shanghai. Ford has benefited from undisclosed subsidies provided by the Brazilian government, and in its financial documents admits that its operations have benefited to a “substantial extent” from those perks.

It is interesting to see that a few countries, contrary to the U.S., allow their regions to challenge other region’s subsidies. Ford has caused a conflict between two local governments in Brazil, where the State of São Paulo challenged tax breaks granted to the company by the State of Bahia.

It’s important now more than ever to increase the global transparency around corporate subsidies – and the U.S. is in a prime position to take the lead. For one, many of the companies are U.S.-based and learned subsidy extraction at home. Secondly, the implementation of federal policies such as the CHIPS and Science Act and Inflation Reduction Act sent a global shockwave across the world in the realm of subsidies. The European Union is known for restricting subsidy use, for example, but it loosened its subsidy regiments in response to U.S federal subsidies.

The FASB disclosure could be much stronger, requiring companies to provide a full accounting and disclosure of domestic and foreign subsidies, broken by county, province, and amounts. But if companies take the requirement seriously and disclose the required information in a comprehensive and accessible way, the public (and company investors) can better understand the costs of projects here and abroad – and hold companies accountable for the money they take.

*Converted by GJF as of April 8, 2024

The Investigative Post wrote a detailed story based in part on a recent Good Jobs First,

The Investigative Post wrote a detailed story based in part on a recent Good Jobs First,